Dialing modes available

MightyCall offers three dialer modes to fit different calling strategies and volumes. As an auto dialer for insurance agents, it provides flexible options to handle everything from client renewals to cold lead outreach.

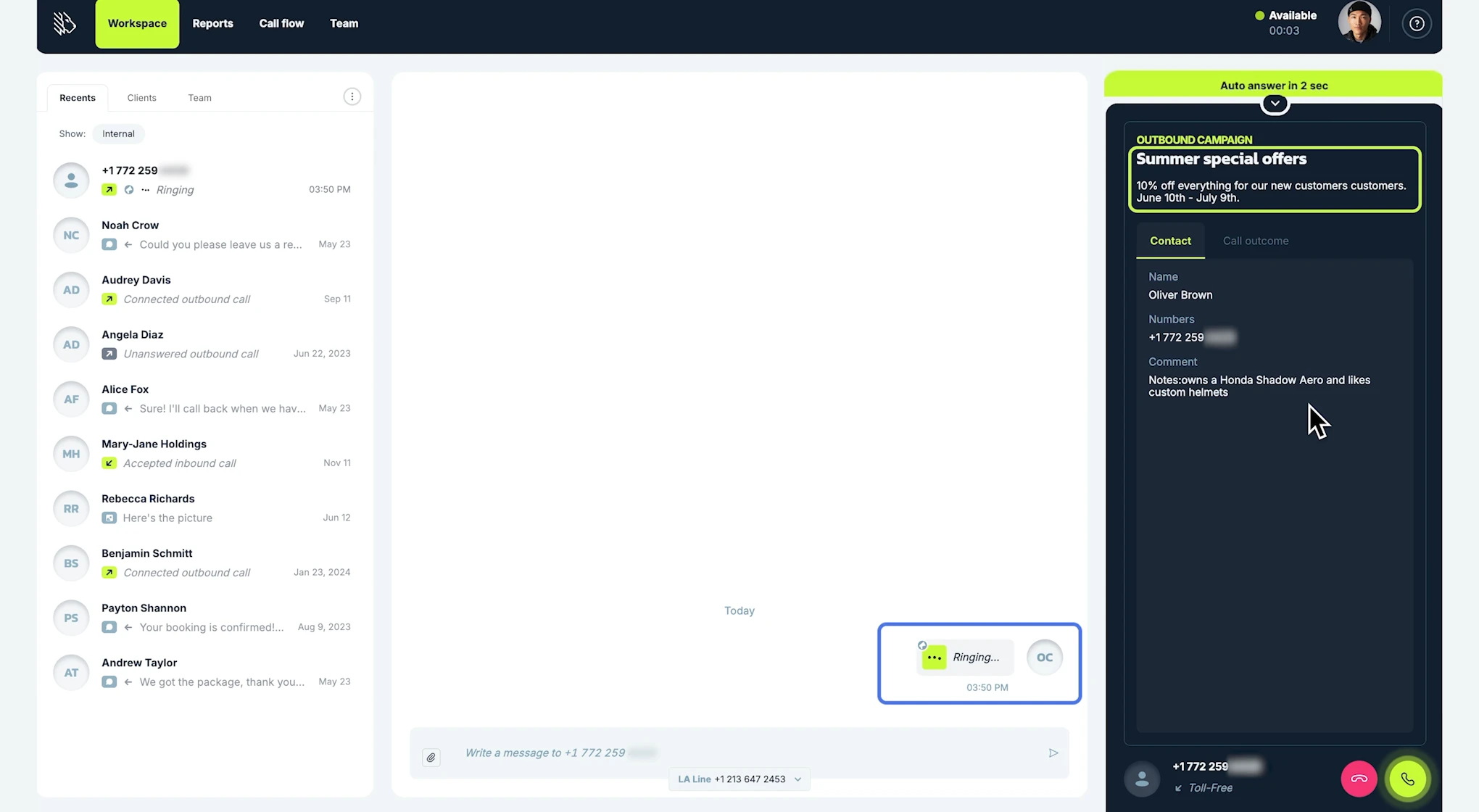

- In Preview mode, agents can see client details before making a call, enabling a personalized touch for complex insurance cases. With this mode, agents can also choose whether to accept the call request and work on the case or decline it. If they decline, the system automatically redirects the call to another available agent.

- Progressive mode automates dialing by placing one call for each available agent. As soon as an agent finishes a conversation and becomes free, the system dials the next number in the campaign list. This ensures that staff are not overwhelmed while maintaining a steady flow of conversations.

- For maximum volume, Predictive mode dials multiple numbers simultaneously and connects agents only when a live person answers, greatly reducing idle time. Perfect for high-volume campaigns such as reaching out to hundreds of new insurance leads, it ensures agents spend more time speaking with prospects and less time waiting between calls.

MightyCall offers all the auto dialer modes a team may need, making the choice of the right mode essential to campaign success. With the right strategy, insurance teams can balance call volume and call quality to match their specific goals.