On January 14, 2020, vice president and general manager of Shopify Financial Solutions Kaz Nejatian announced the launch of a new product from Shopify Capital. The program of loaning money to e-commerce owners has started giving out all-time low $200 starter loans for e-commerce startups.

With no personal guarantees, credit history, or paperwork needed to get a small business loan, Shopify is giving aspiring e-commerce owners carte blanche to try their hand at entrepreneurship. Moreover, it’s bound to widen the demographics of small online businesses. The new risk-free loan will motivate U.S. merchants to open millions of e-commerce stores.

Why is Shopify giving out $200 loans?

Online businesses are some of the most budget-friendly ways to get into entrepreneurship. With a lot of business hassles eliminated (i.e. extended documentation, store rental, hiring staff, etc.), online businesses can do business in ways undreamed of by brick and mortar stores– from drop shipping to digital services. They also don’t need any kind of office, with work often being coordinated from home.

Shopify credit has been offering loans to Shopify merchants in the U.S. since 2016. However, they have never been this accessible before. The new $200 starter loans take the ease and diversity of setting up an online business a step further and supplement what the first-time online entrepreneur is usually missing: starter funding for essentials like marketing and advertising.

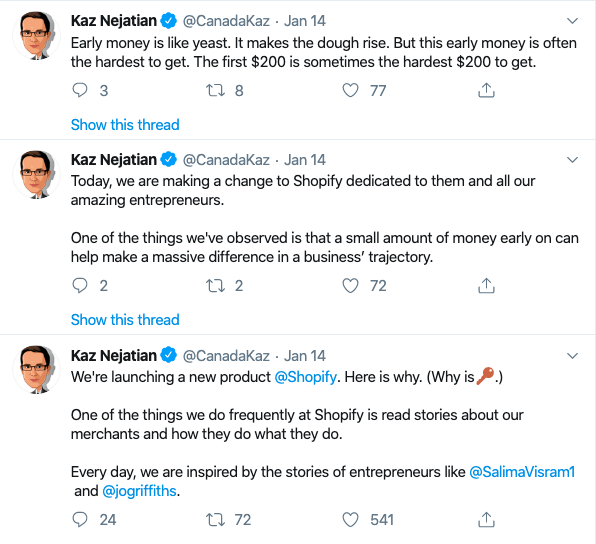

As expressed in his Twitter post, Kaz Nejatian is sure that $200 Shopify starter loans will be in demand and will lead to greater diversity in the online marketplace.

Screenshot via Kaz Nejatian’s Twitter profile

Nejatian has countless examples up his sleeve of how a few hundred dollars at the right time can give wings to a business. He is sure Shopify’s new loans will open entrepreneurship doors to those for whom they’ve been shut before.

How are Shopify’s $200 loans different from a regular loan?

One of the greatest things about Shopify’s $200 starter loans is they’re really risk-free. Which in turn, means they’re guilt-free for your business.

To get Shopify’s $200 loan, you won’t have to offer personal guarantees or go through the dreaded credit check. Shopify provides the loan for a period of 12 months. You pay it back automatically as a fixed percentage from sales, every 60-day period. This includes the loan amount plus a fixed borrowing cost calculated on an offer-by-offer basis.

The main difference with Shopify’s starter loan is that in case your online business doesn’t make any or enough money to repay the loan, the sum will just be deducted from your bank account. This will not affect your credit history in any way.

How can I get Shopify’s starter loan?

While it’s easy to get into the program once you’re eligible, Shopify does have territorial restrictions for getting into its loan program, plus several platform requirements.

To qualify for Shopify’s starter $200 loan (or a greater sum of your choice), you must:

- Have an online store registered in one of the currently 14 eligible U.S. states: Arizona, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, North Carolina, South Carolina, Utah, Washington, Wisconsin, or Wyoming.

- Have a Shopify business or use Shopify Payments

- Link your bank account to Shopify. This is where Shopify deposits your loan. In case your business makes no revenue, it will deduce the loan+fixed borrowing cost amount from your savings.

Final Word

Shopify’s $200 starter loans are perfect for e-commerce first-timers setting up a dropshipping or niche craft store (handmade products that don’t demand a lot of investment in materials) — industries that can launch on an initial investment of as low as $150-$200.

Invest this amount in your first social media ad, branding, consultation with a business coach, etc. If you’ve been waiting for “the right time” to try a hand at online business entrepreneurship, this is it.

For more experienced business owners, Shopify Capital offers loans and cash advances to business owners ranging from $200 to $1,000,000.

New to online business? Get the heads up on starting a virtual online business: How to Sell Virtual Products from Home