With income tax season just a month away, small business owners are on their toes about reducing small business taxes and preparing paperwork in a no-fuss, hands-on way.

While we’ve got fingers crossed that you’ve been thinking of tax season ahead of time and don’t make it into the 25% of small business owners who’re frantically preparing at the last moment, getting ready for April 15th can be nerve-racking at any point.

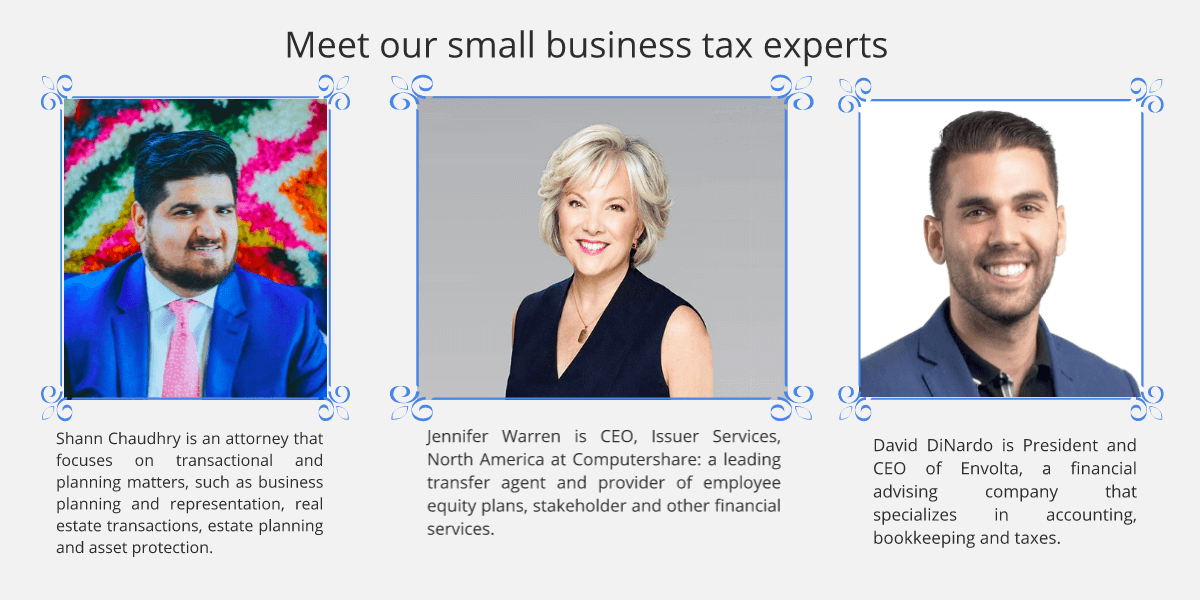

That’s why we talked to tax and finance experts and gathered professional insights on getting the most out of your small business taxes. Today, we’ll find out how to get more tax deductions while investing in your business and future, spreading the message of care, and saving yourself time on paperwork throughout the year.

Use these tips ahead of small business tax season and save them for the year ahead!

Navigation:

- Spend money on your business

- Donate and use Charitable Remainder Trusts

- Keep aligned with new 2020 tax laws

- Are you filing investment income taxes?

- Keep organized throughout the year with these digital tools

1. Spend money on your business and get small business tax deductions

According to experts, small business owners are more likely to cut back on equipment costs instead of buying equipment and investing the resulting tax deductions into growth. In order to expand business and get more deductions, tax attorney Shann Chaudhry, ESQ., recommends the opposite approach.

“If you are in need of additional business expense deductions… consider making some equipment investments or prepaying some expenses so that they will be deductible [already this year].”

Making your business expenses deductible this year is especially relevant in light of 2020’s First-Year Bonus Depreciation tax law which makes equipment and property purchases 100% tax-deductible (we’ll cover that in more detail below).

Here’s a handy list of tax-deductible small business expenses

- Advertising and marketing — including ads, digital marketing, web promotion, and events

- Home office — if you work from a home office and have a designated room or even couple of square feet that can be proven (i.e. by photo) as your principal working location, you can deduct $5 per square foot of your home that is used for business or track all home office expenses and multiply them by the percentage of your home allocated to home office use.

- Education — courses, seminars, workshops, and even subscriptions to business-related educational content

- Vehicle — expenses for a separate vehicle that you use only for business

- Property — deductions are available for everyone renting out a business office

- Moving — when moving equipment to a new business location

- Travel — business transportation, hotels, and even business meals

- Meals — 50% deductions are available on food and beverage as part of necessary business meals, while office parties and picnics are 100% deductible.

When it comes to business expenses, Small Office/Home-Office (SOHO)-type businesses often neglect to keep a detailed account of “insignificant” expenditures. Since the process can be a bit tricky for small businesses to get right on their own, Chaudhry suggests seeking professional help to “ensure that all of the IRS requirements are met and that you’re properly reporting the transactions on your tax return.”

To track smaller expenses such as mileage, travel, and meals, always use digital tools (we’ll cover that below) to stay organized. Remember that being attentive to the needs of your business while documenting spending throughout the year will get you the most tax benefit.

2. Donate to charity and use Charitable Remainder Trusts

Did you know that over 85% of your customers want to see your business give to a cause they support? Or that over two-thirds of Millenial and 47% of Gen X employees prefer to work for a company that gives to charity? For a business, giving back means standing strong with the community, putting yourself out there as a sustainable company, and reducing small business taxes all at once. Isn’t that a great deal for any company?

While standard charity tax deductions may not amount to much for sole proprietorships, LLCs, and partnerships, many SMBs are eligible for less-known tax deductions when they consult with a professional. Experts recommend talking to your personal tax advisor about claiming the charity tax deduction on Schedule A, looking into a donor-advised fund, or Charitable Remainder Trusts.

Shann Chaudhry, ESQ., comments:

“Some folks may be familiar with Charitable Remainder Trusts (CRTs) as an estate tax reduction technique. Typically, you’d receive an income stream for years and then your gift to the trust passes to your most beloved charity. [However] CRTs are also effective in reducing income taxes under the right circumstances.”

When arranging a Charitable Remainder Trust, you can “take an income tax deduction, spread over five years, for the value of your gift to the charity” (Nolo legal encyclopedia). However, the IRS will deduct the amount of income you’re likely to receive from the property, out of your overall donation.

3. Keep aligned with 2020 small business tax laws

In 2019, the Trump Administration passed some considerable SMB tax reforms. The most important of these is the Tax Cuts and Jobs Act with its 20% pass-through deduction. In 2020, you can take advantage of the huge 20% deduction. This applies if you’re a sole proprietor, partnership company, LLC or S corporation with a taxable income of less than $157,500 (for singles) or $315,000 (for joint filers). If your income is above the threshold, you can still find a loophole if you qualify as a “qualified trade or business”.

Another considerable change in 2020 is the First-Year Bonus Depreciation deduction, which is now 100%. This means business and property expenses are fully deductible and you don’t have to wait and write off a portion of the expense each year. This new law is meant to encourage business owners to invest the money back into business growth.

Any time when you hear about tax laws being modified, Chaudhry advises talking with your attorney right away in order to “thoroughly understand what you can deduct and depreciate.”

4. Are you filing investment income taxes? Don’t put it off until last moment!

If you run your own business and have shares or equity in the employer, you will also need to get your investment income prepared ahead. This is usually done through 1099 forms (for declaring investment income).

Jennifer Warren, CEO of Issuer Services, North America at Computershare offers the following tips for small business owners filing investment income forms:

- Gather your materials – Make sure you have all the forms you need before you start. Depending on your holdings, you may need several, and it’s best to gather everything together before sitting down to work out your tax. A 1099-DIV form is for declaring income on dividends, a 1099-B is for income on sales or transfers.

- Don’t forget cost basis — If you sold shares in 2019, it’s likely you will need to report your ‘cost basis’, which is the original purchase price of your holding. The information for this will be in your 1099-B form.

- Watch out for fraud — Tax season is also fraud season. You should only share information with known, trusted sources.

- Start early — Don’t start filing your taxes at 11 p.m. on April 14. Remember, even if you have an extension, you will still need to pay interest until the day you file.

- It’s OK to get help — Investment income is tricky to figure out, especially if you are filing taxes for the first time. You may find that using tax filing software or the support of a professional tax accountant can be worth the investment.

5. Keep your small business taxes and accounting organized with digital tools

The best way to sail through tax day with maximum deductions is to keep your accounting tidy throughout the year. Gone is the time when every single receipt had to be stacked in paper format and displacing something could lead to missing out on a deduction.

David DiNardo, President and CEO of financial advising company Envolta, advises business owners to stop hunting down documents, filling our excel datasheets and producing ledgers by hand, and instead transition to cloud tools.

“Smart accounting software programs can automatically upload, file, and organize all your financial documents in one place. They can even be used to sync with other bookkeeping software to reconcile accounts, send invoices, and produce instant reports, all at the touch of a button.”

Commenting on his preferred digital tools, David recommends syncing services like Hubdoc and Xeno for maximum transparency.

“[Hundoc] is software that allows you to snap a photo of your receipts, forward invoices from your email or sync your accounts for automatic uploading. After that, it extracts all of the key information from the document and exports it into data you can utilize in the cloud. … You can then sync it with Xero, another cloud accounting software, in order to create reports, send invoices, receive online payments, track accounts receivable and payable, reconcile accounts, and much more.”

Don’t forget!

Nearly 40% of surveyed small business owners say they don’t use an accountant to help reduce small business taxes. The reasons range from having a bad experience in the past (19%) to considering the costs a deal-breaker (19%), and not understanding the value of professional help (18%).

To reduce small business taxes, get familiar with new tax laws, and make the most out of your deductions, always seek professional guidance from your tax attorney or accountant.